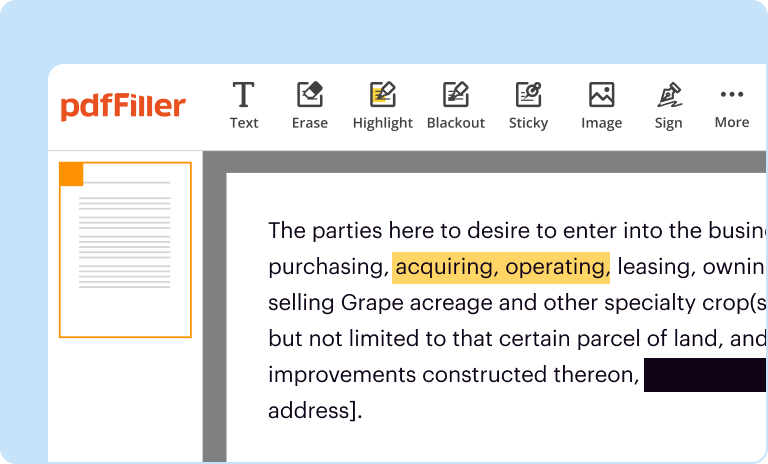

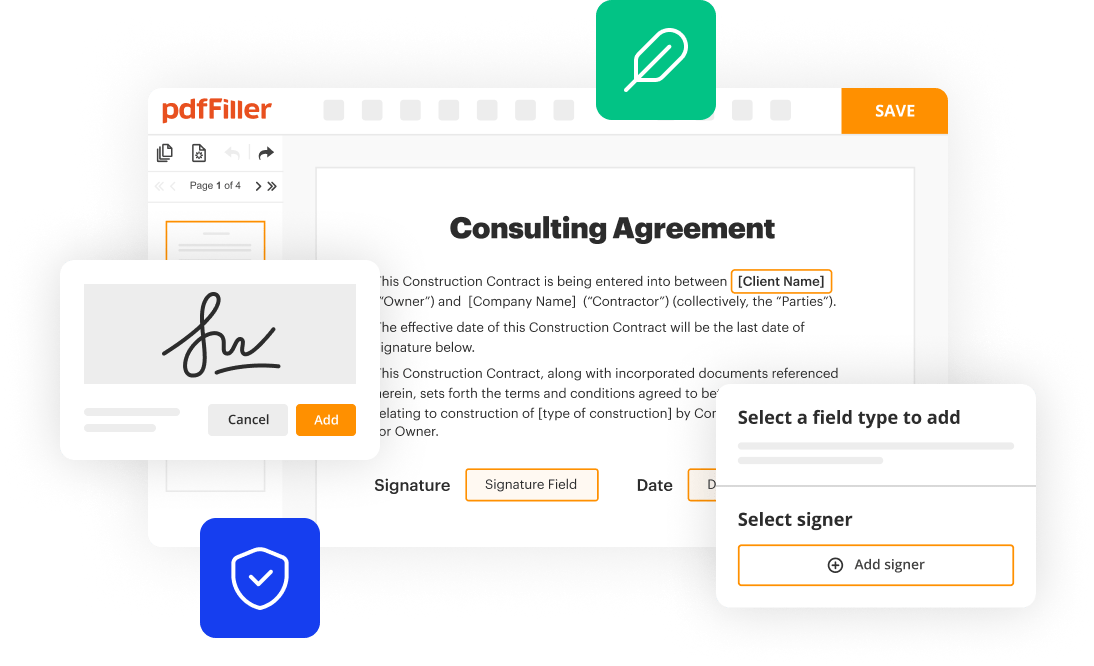

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

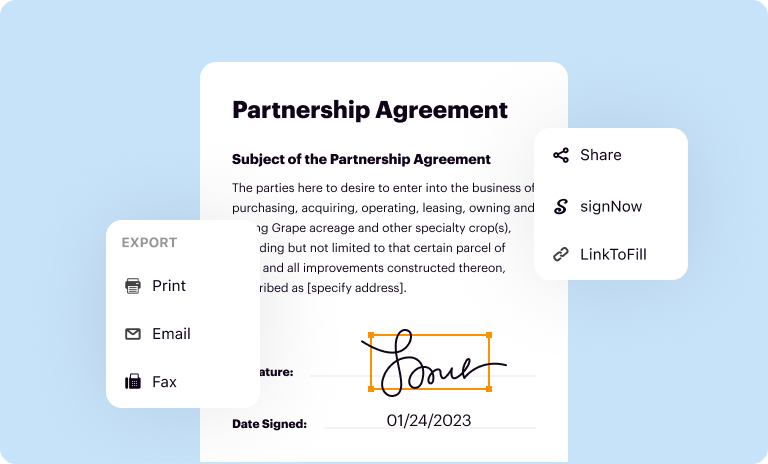

Email, fax, or share your noc for debit card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

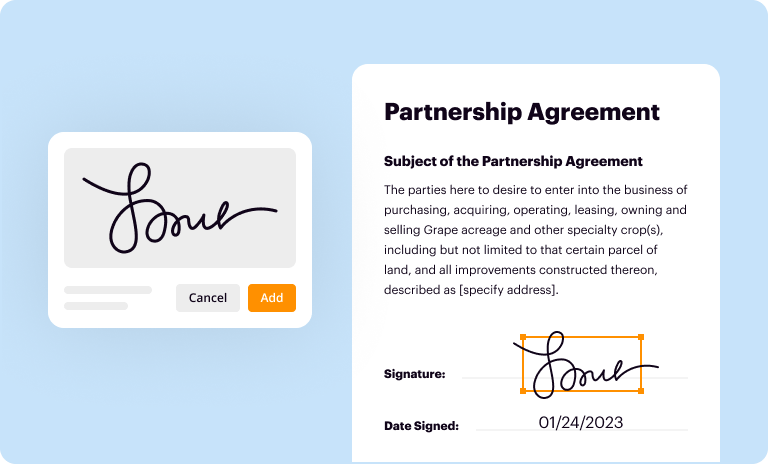

Edit noc for debit card. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Contact your bank: Begin by reaching out to your bank's customer service department either through phone, email, or in-person visit to inquire about the procedure for obtaining a NOC (No Objection Certificate) for your debit card.

Provide necessary information: The bank representative will ask you to provide certain details such as your account number, name, address, and any other identification information they might require. Make sure to provide accurate and up-to-date information to avoid any delays in the process.

Complete the NOC form: Once you have provided all the necessary information, the bank will provide you with a NOC form. Fill out the form thoroughly and double-check for any errors or missing information before submitting it.

Attach supporting documents: In addition to the NOC form, the bank may also request you to submit certain supporting documents. These documents could include a copy of your identification card, address proof, and any other documents specified by the bank. Make sure to attach these documents securely with the filled-out NOC form.

Submit the NOC application: After completing the form and attaching the required documents, submit the NOC application to the bank. Find out from the bank representative the preferred method of submission, whether it is through an online portal, in-person at a branch, or by mail. Follow the given instructions and ensure a proper and timely submission.

Joint account holders: If you have a joint account, meaning the account is co-owned by multiple individuals, all account holders may need to obtain a NOC to make changes or close the debit card associated with the account.

Closed or dormant account holders: If you have closed or dormant accounts, the bank may require you to obtain a NOC before activating or reissuing a new debit card for that account.

Change in account ownership: In case of a change in ownership of an account, such as due to a marriage, divorce, or inheritance, the new account holder may need to obtain a NOC for the associated debit card.

Special circumstances: Certain banks or financial institutions may have specific cases where an NOC is required, such as in cases of suspected fraud or to comply with regulatory requirements. It is advisable to contact your bank directly to understand if you fall under any such circumstances.

Note: The specific requirements for obtaining an NOC for a debit card may vary between banks and countries. It is recommended to consult with your bank or financial institution to obtain accurate and up-to-date information on their NOC procedure.